How Useful Are Prediction Markets, Anyway?

It’s still just guessing…

What Is It?

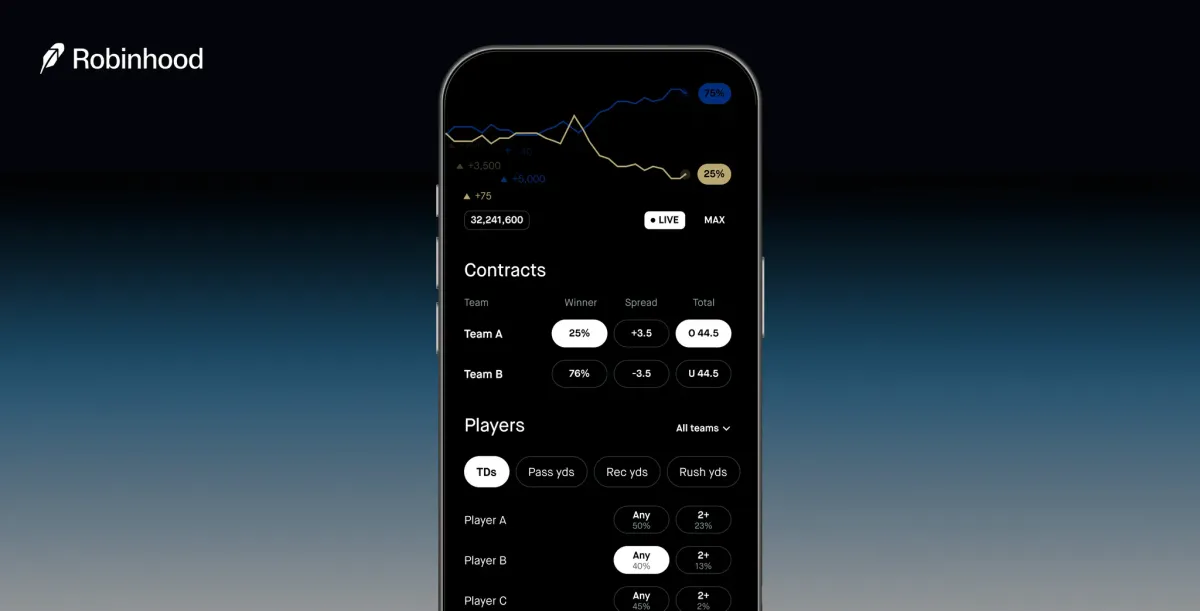

The basic idea with prediction markets is that people will buy contracts on the outcomes of particular events in real life. From a process perspective, it’s effectively a stock or commodity future—you buy a contract based on whether you think the stock or commodity will go up in price and someone else hedges against it.

By placing these contracts on other events in real life, the idea is that they’re going to give some kind of real-world prediction on the outcome of these events. The idea is that, because people are willing to put some money on the line, they have some informed idea on what’s going to happen. This leads a lot of the proponents of these prediction markets to present those odds as the actual odds of The Thing happening.

Do I Think It’s Useful?

Ultimately I do think it’s somewhat useful, but I don’t think it’s all that the prediction market apps are cracking it up to be. While they do help give some sense of where people think things are going to go…it’s nowhere near statistically sound.

With any new asset class, the people who buy in first are the ones willing to accept the most risk; far from a statistically sound random sample of people. Even then, a collective opinion is not at all equivalent to the actual outcome of the event; especially when those people’s opinions have no actual bearing on the outcome.

For example: if Robinhood’s prediction market has one team’s contract trading at 79¢ for winning the game, their assumption is a 79% chance of that team winning, but there’s no actual link between the contract and what’s actually going to happen. The opinion of a bunch of Robinhood users cannot determine the outcome of the game and it’s disingenuous to convey the information in that way.

What’s Actually Going to Happen?

Well, it’s not really gambling, so it’s likely going to continue to operate relatively similar to the way it operates now. On top of that, the current administration is not terribly keen on regulating the financial markets (and is, well, actively trying to deregulate in many cases), so we’re not going to be able to count on to make this a more viable asset class.

We’re going to run into another NFT kind of situation here. If there’s no regulation or education, then there’s not going to be any kind of real use for the asset class. While it’s not actually gambling, without the regulation, especially around insider trading of these contracts, then there’s no reason for the average person to ever seriously consider the asset class or even treat it as anything other than gambling.