Robinhood Just Made the Banking Product Apple Should Have

Just this week Robinhood announced a comprehensive set of banking products as Apple struggles to keep its credit card alive

Okay so I know that Robinhood got a lot of bad press years ago, but I was a user well before then and I’ve been a customer well after then and I can tell you they’re doing some super interesting stuff in the world of personal finance. Most banking apps, in all honesty, are shit. The Apple Card’s integration in the wallet app is probably the best credit card app out there, but it’s super barebones. Robinhood’s relatively new Gold card and accompanying app really give the Apple Card a run for its money. Sure, it’s not technically free, but I feel it’s ultimately a better product.

What Robinhood Just Announced

This week Robinhood announced 3 new features: an in-house financial advisory team, a comprehensive set of intelligent recommendation systems, and a new private banking product (are you getting it?). Robinhood says that it’s combining the best of human and robotic financial management with actual humans working in tandem with intelligence systems and a novel fee structure that’s honestly great.

Typically a financial advisor will charge as a percentage of “assets under management” so say the fee is 1% of assets under management, each year they will take 1% of your assets as compensation. Robo-advisors come with the benefit of not having to put food on the table, so they will charge a lower fee, say 0.25% assets under management. The problem with this fee structure is that, when you start to grow that portfolio, you start really paying for that advisor. Robinhood is matching that 0.25% assets under management fee, but is capping the fee at $250/year. That means whether you have $10,000 or $1,000,000 under management, you’re paying the same fee, which is ultimately better for you as your money grows.

The intelligent recommendation system is your run-of-the-mill AI-powered tool, it’s going to do a lot like summarize the news around a certain stock, it’ll help with creating trades, it’s about what you would expect in the year 2025. It’s cool, but even this AI enthusiast is kinda burned out with the whole thing.

What I Found Most Interesting

Robinhood is going to be turning its credit card app into a full banking solution. As far as financial apps are concerned, Robinhood nails it so I’m super excited for this. They also typically have pretty good rates, there are a lot of interesting family-centric features including supporting joint accounts from the get-go, as well as features for kids like allowances. I haven’t used the product, obviously, but if it’s anything like the rest of what Robinhood has put out, it’s going to be interesting. I’ve been using Robinhood as my main banking solution for a little while now, even without a traditional savings account, so this will be an easy progression for me.

Apple’s Nowhere Close

For a while Apple enthusiasts have wanted the company to really build out the Wallet and Stocks apps into full on banking solutions, but that hasn’t really panned out. Apple’s credit card product is struggling to stay alive, its high-yield account isn’t very competitive, and they haven’t really touched the Stocks app in years. It feels like Apple is losing steam in the financial space. They even killed ApplePay Later less than a year after actually rolling it out (I was approved, but I never used it for anything).

With the crackdown on Big Tech around the world for the past few years, it’s unlikely Apple would really be able to make much more headway in the banking world without catching the attention of regulators, and the financial space is chock full of those. With that being said, I think that it’s safe to say Apple won’t be expanding their financial products much in the future.

Robinhood Has Filled the Void

For me, Robinhood has filled that void. Their apps are great, their credit card has a better cash back breakdown, and it’s really replaced the Apple Card in my life unless I’m doing monthly installments through it (which is rare). Ultimately, I don’t see Apple breaking into this space like this, but Robinhood is here and it’s thriving. Sure, there are products they offer that are kinda dumb, like crypto and their betting markets, but their core trading product, their credit card, and their IRA products are all incredibly solid and I don’t see myself moving off them anytime soon.

Closing Thoughts

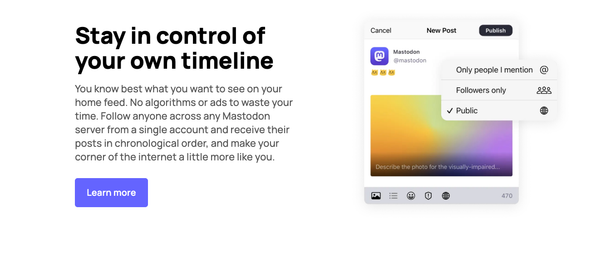

So, the tl;dr is: I think this stuff is pretty cool. I’ve been interested in Robinhood as a company since they first came onto the scene and I’m really impressed with how far they’ve come as a company. What do you think about these new announcements? Are you interested in any of them? Does any of what they’ve announced change your perception of them as a company? Let me know down below, on Bluesky, or on my personal Mastodon. Feel free to follow us from the fediverse as well!

Lastly: there’s now an option to subscribe to The Digital Renaissance and support my work. I’m in the process of trying to figure out something cool to offer subscribers, but for right now it’s really just an opportunity to support my work both here and over at Stygian Tech. Thanks!