Voting With Your Dollar Doesn’t Mean Shit Anymore

Hooray for late-stage capitalism

It’s been a time honored phrase, especially in the tech world (but also in the activism world) that people should “vote with their dollar” or “vote with their wallet”. What this basically means is that, if you don’t agree with something a corporation is doing, you should not be giving it your business.

Voting with your dollar has been used in many different contexts. In some cases it can be used to protest things like not putting a high refresh rate display on the iPhone. In other cases it’s used to protest things like unsafe working conditions or problematic management decisions.

Additionally, in some cases it doesn’t have anything to do with paying, it’s generally just a boycott. In the case of social media apps like The Platform Formerly Known as Twitter or anything Meta has touched, they get revenue from ad sales and the value of those ads is determined by views. The fewer people who view the ads, the less those ads are worth.

The Problem

Wealth is In Capital Gains

So the actual goal here is to hurt the CEOs of these companies where they really care: their net worths. The problem with that is that most of their net worth isn’t money, it’s in stock in some form. The idea here is that their pay is based on performance—the better they do at their jobs, the more valuable that stock is going to be. They don’t have access to that money easily, they need to sell stock and pay taxes on that (in theory). There are ways around that like taking out loans or a line of credit against the values of those shares.

What I’m getting at is that their “income” is capital gains. It’s not based on how much money the company makes.

Valuations are Speculative

Like I was saying—their net worth is dependent on the valuation of the company, not how much money the company makes. Corporate valuations are determined by the value of future cash flows—how much money the company is going to make in the future.

Additionally, companies can artificially inflate their valuations—which is illegal (of course, there are ways around that)—as well, meaning that it’s really just based on vibes at this point. Companies can make promises they don’t keep and have that still blow up their valuation. With the right person in charge, and the right investors, this could be a dangerous combination.

A Lot Goes on Behind the Scenes

Think about Tesla and how its valuation is not based on how many cars it’s sold. If we’re being honest its valuation isn’t even based on how many cars it will sell. Tesla’s valuation—and all companies’ valuations—are based on how much money they will generate by any means. This includes some shadier things like government deals (ring a bell?).

Companies Dying Are Write-Offs

Okay so here’s the thing: capital gains are taxed based on total change. If you make $1,000,000 in capital gains on Nvidia stock, but you lose $500,000 on Bitcoin (a capital loss), all you are taxed on is $500,000. So say you experience a capital loss of $44 Billion because a particular company you bought goes under and dies. You now have $44 Billion of capital gains you won’t be taxed on (there’s nuance to this, of course, but this is the general idea). Basically, those losses in valuation don’t really affect how much money they have, just their net worth. Which are two different things.

What Can We Actually Do

So really the only thing you can do is vote. Like for reals vote. Your governments can regulate these companies to actually serve what’s best for the people.

These companies and people have grown so large and wealthy that a lot of what determines that is just way above our pay grade. A lot of their value is determined by large investment firms and VCs. How much money a company has made has never been an indicator of value. Many companies have huge valuations and have never actually made any money. This is why companies can be doing layoffs while CEOs spend a shitload of money on weddings to their “I’ve-lost-count-at-this-point”-th wife.

Wrap Up

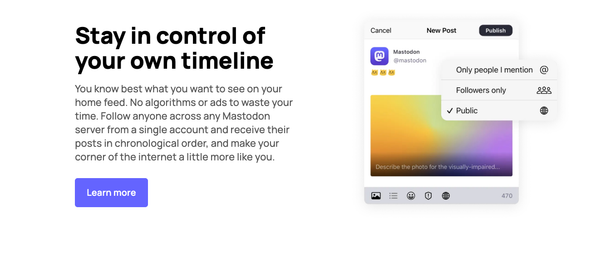

So to sum this whole thing up: you can’t do shit. Deleting your Meta accounts doesn’t do shit. Deleting your Twitter accounts doesn’t do shit. What matters is putting people in charge who can and will do something about it. Thoughts? Hit me up on Mastodon.